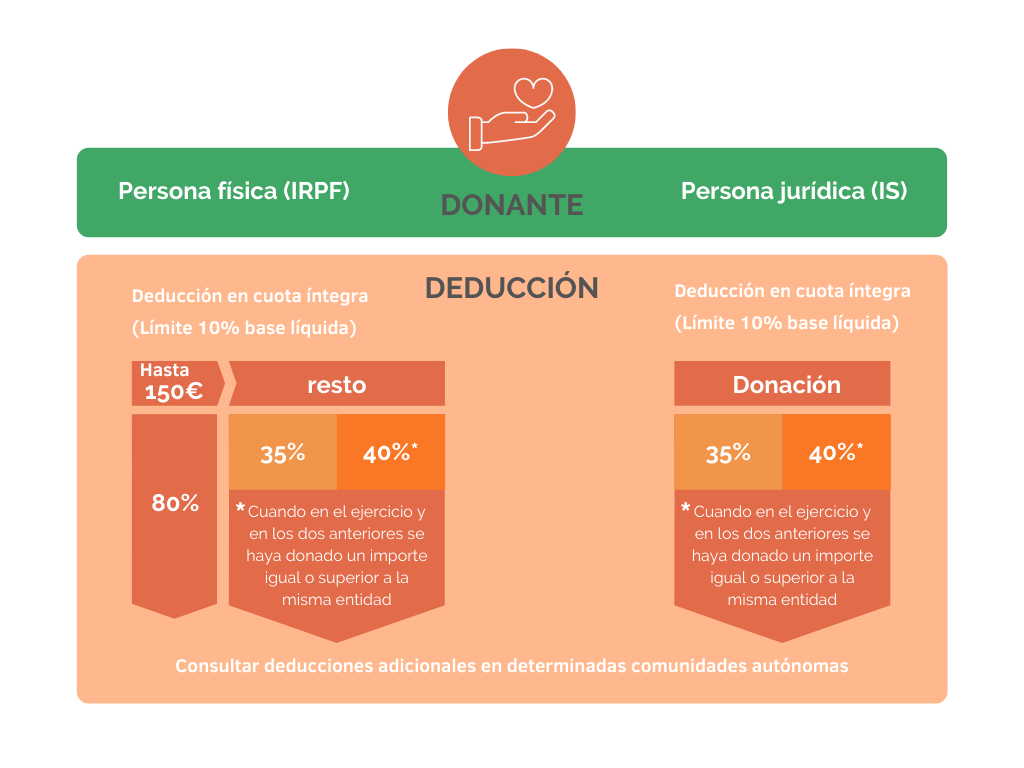

Helping MONA has advantages

Fundación MONA is a public utility NGO that has the legal form of a non-profit foundation and complies with the requirements set forth in Law 49/2002 on the tax system of non-profit entities and fiscal incentives for patronage.

* If you pay taxes in Catalunya, you will get an extra 15% tax deduction.